COMMENT ON PROPOSED RATE INCREASES FOR

DWELLING FIRE AND WIND POLICIES

COMMENT PERIOD ENDS THIS FRIDAY, AUGUST 25th

The NC Rate Bureau submitted a Filing to the NC Department of Insurance (NCDOI)to increase DWELLING Insurance rates for fire and extended (wind) coverage. Dwelling policies are different from Homeowner policies. Dwelling policies typically cover second homes, vacation rental homes or year-round rental homes.

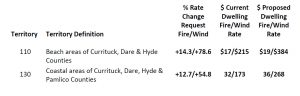

The NC Rate Bureau is requesting an average 16.1% increase for fire/liability and 59.8% for extended (wind) coverage statewide. These rate increases are substantially higher for the Outer Banks as illustrated below. Fire rates are typically much lower than wind rates and this filing will have tremendous impact on Dwelling and Dwelling Wind Only policies written through the NC Insurance Underwriters Association (NCIUA), commonly referred to as the Coastal Property Insurance Pool, and other carriers.

NCIUA polices are surcharged over and above the maximum rate approved by the Department of Insurance. Increased rates on dwelling policies in the Outer Banks of 12.6% and 12.3% respectively just became effective on June 1, 2023, and now another rate increase has been filed.

The Rate Bureau is requesting the following Dwelling policy rate changes based on $15,000 Coverage, Protection Class 5 with Frame Construction to become effective on June 1 2024:

IT IS IMPORTANT THAT NCDOI HEAR FROM YOU!

PLEASE EMAIL YOUR COMMENTS ASAP TO NCDOI.2023DwellingandFire@ncdoi.gov

Some suggested comments are included below.

Contact OBAR Government Affairs Director at dvcreef@gmail.com if you need more information.

When submitting comments, include your name and NC property address. In addition to sharing your personal opinion regarding the impact of the proposed rate change, feel free to include any of the following:

Dear Commissioner Causey,

I/We respectfully request that you DENY the 2023 Dwelling Rate Filing. Based on the data and information included in the Filing, the NC Rate Bureau’s proposed rate increase request is unwarranted and unjustified. In addition:

- Rate increases of 12.6% and 12.3% for territories 110 and 130 respectively for extended coverage dwelling policies became effective on June 1, 2023. Another rate increase is unreasonable and should not be considered until these newly effective rates have been analyzed for their adequacy.

- The latest filing requests extended coverage rate increases for territory 110 of 78.6% and for territory 130 of 54.8%. These requested rate increases are excessive and unfairly discriminatory compared to other rates elsewhere in North Carolina. They are unsustainable for policyholders and residents of North Carolina.

- To offset increased insurance costs, policyholders of rental properties will pass any increased insurance premiums onto their renters by increasing rent prices. Renters are the foundation of our service industry, our first responders and our government employees. The percentage of their monthly income is already disproportionately dedicated to housing costs. Additional rent increases will have drastic financial impacts on the residents of North Carolina who live in rental properties.

- Admitted carriers in North Carolina are limiting their exposure in coastal areas by discontinuing coverage in these areas. This limited coverage coupled with increased premiums is creating an insurance crisis.

- Decreased exposure for insurance companies means increased exposure for Outer Banks residents and other coastal residents. Policyholders in X zones or Shaded X flood zones will choose to discontinue their flood insurance leaving them extremely vulnerable to flood hazards. Or they may choose to decrease their coverage on their dwelling to be insufficiently congruent with their structure value. Policyholders should not be forced to accept insurance coverage that is inadequate to address the natural hazards of North Carolina.

- The requested rate increases are excessive and unfairly favor insurance companies. Attainable coverage plus sustainable rates equal fair insurance for policyholders.

- Communities that are not adequately insured cannot adequately recover from storm events.

- The requested rate increases are excessive and unfair and this filing should be DENIED.